|

|

| What it Is | At-a-Glance | For Example | What If | |||||

|

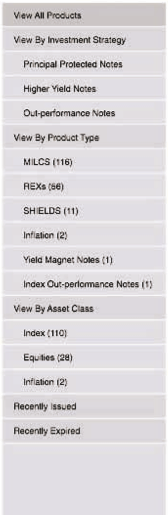

What are Higher Yield Notes? Higher Yield Notes provide investors with periodic fixed coupon payments while basing the payout at maturity on the performance of an underlying asset. In some cases, investors may be delivered the underlying asset at maturity. The fixed coupon payments typically are higher than the yield payable on a conventional debt security with a comparable issuer, maturity and credit rating. Investors give up, or ‘trade off’, some or all of the upside exposure in the underlying asset in order to benefit from the enhanced coupons. Any underlying asset delivered at maturity will have a cash value below the original principal amount of the notes, possibly significantly below, and such value could be zero. In this Section * Higer Yield Notes

Higher Yield Notes may be linked to a variety of asset classes, but are typically linked to single stocks. The amount payable under Higher Yield Notes will never exceed the original principal amount of the notes plus the aggregate fixed coupon payments investors earn during the term of the notes. This means that investors will not benefit from any price appreciation in the underlying asset nor will they receive dividends paid on the underlying asset, if any. Higher Yield Notes may be an appropriate investment for investors seeking enhanced yield who are willing to take the risk of loosing some or all of their initial investment, risk owning the underlying asset at maturity and who think that the underlying asset will trade in a range during a given period. |

||||||||