|

|

|

| Overview | How to Calculate | For Example | Risk | |||||

|

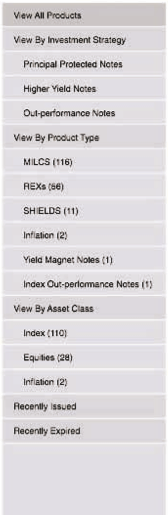

Reverse Exchangeable Securities (REX) Reverse Exchangeable Securities (REX) combine certain features of debt and equity by offering fixed coupon payments during the term of the securities while basing the payment or delivery at maturity on the price performance of an underlying stock. The fixed coupon payments typically are higher than the yield payable on a conventional debt security with a comparable issuer, maturity and credit rating. A higher fixed coupon rate is possible because the investor indirectly sells a put option to the issuer on the underlying stock. The put option gives the issuer the right to deliver the investor stock at maturity rather than make a cash payment if the closing price of the underlying stock on the determination date is less than the closing price of the underlying stock on the date the securities were priced. This is why we call these securities ‘exchangeable’. Unlike ordinary debt securities, REXs do not guarantee the return of principal at maturity. Instead, what investors receive at maturity is dependent upon the price performance of the underlying stock and will be either a cash payment equal to the original principal amount of the securities or a predetermined number of shares of the underlying stock. Any stock delivered at maturity will have a cash value below the original principal amount of the securities, possibly significantly below, and such value could be zero. Accordingly, investors may lose some or all of their initial principal investment in the REX. The maximum return on the securities is the original principal amount plus the aggregate fixed coupon payments. Alternatively, investors may lose all of their principal investment in the securities and in such case, the only payment investors will receive on the securities is the aggregate fixed coupon payments. Investors do not benefit from any price appreciation in the underlying stock.

Reverse Exchangeable Securities may be structured to provide investors with exposure to virtually any common stock or American Depositary Receipt that is traded on the New York Stock Exchange, Nasdaq National Market, American Stock Exchange, Pacific Stock Exchange, Boston Stock Exchange or Philadelphia Stock Exchange. |

||||||||