|

|

|

| Overview | How to Calculate | For Example | Risk | |||||

|

IONs: In a Nutshell If held to maturity, IONs give investors an opportunity to participate in a multiple of any appreciation of an underlying index. However, the amount of participation will be limited by a predetermined cap. IONs are not principal protected securities; therefore, 100% of principal will be at risk. This means that investors may lose some or all of their initial investment in IONs if the underlying index declines in value. IONs are short dated investments that do not provide for regular coupon payments. Instead, IONs provide for a one-time payment at maturity that will be based upon the capped performance of the underlying index. Because an investor's principal is at risk, IONs should only be considered by the more aggressive investor.

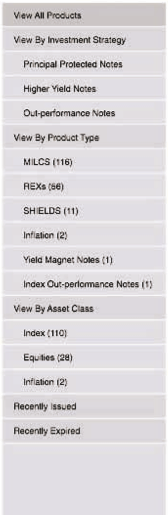

The Underlying Index IONs provide investors with exposure to an underlying index. The underlying index can provide investors with exposure across various company sizes, stock exchanges, currencies, geographic regions and industry sectors, including:

IONs may be linked to some of the world's most popular indices, including, but not limited to, the S&P 500 Index®, the Dow Jones Global Titans IndexSM, the NASDAQ Biotechnology Index®, and other global indices. |

||||||||