|

|

| Overview | How to Calculate | For Example | Risk | |||||

|

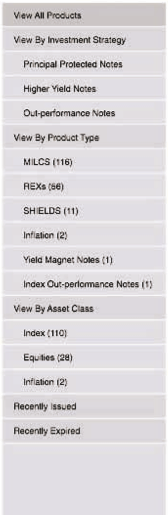

Yield Magnet Notes: In a Nutshell Yield Magnet Notes are an equity linked investment that provide for the return of principal at maturity. In order to benefit from such principal protection, the notes must be held until maturity. Yield Magnet Notes provide for a combination of fixed coupon payments and variable coupon payments during the term of the notes. The variable coupon payments are determined based on the price performance of a portfolio of underlying stocks. Two Magnet features act to "lock in" the price appreciation of the underlying stocks when certain performance criteria are met. The first Magnet feature "locks in" the price performance of one or more of the underlying stocks if a certain level of price appreciation is achieved. The second Magnet feature provides that each successive variable coupon after the first variable coupon will not be less than the prior variable coupon.

Underlying Stock Portfolio Yield Magnet Notes provide investors with exposure to an underlying portfolio of stocks in the form of variable coupon payments after payment of an initial fixed coupon. The underlying portfolio may provide investors with exposure across various industry sectors, company sizes, company names and geographic regions. The underlying portfolio may also be selected to provide investors with exposure to a specific industry group, such as "oil and gas", while diversifying across geographic regions. An example of an underlying portfolio that provides investors with exposure to large-cap equity stocks and is diversified both geographically and by industry sector is as follows: [ Table: Company/Country/Industry Sector ] |

||||||||