|

|

| What it Is | At-a-Glance | Example #1 | Example #2 | |||||

|

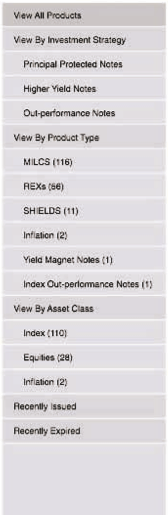

What are Principal Protected Notes? Principal Protected Notes give investors exposure to the appreciation of an underlying asset while providing some degree of principal protection at maturity, subject to the credit of the issuer. In order to benefit from any level of principal protection, the notes must be held until maturity. These structures typically have three-to-five year maturities. Typically, an investor’s return is dependent upon the performance of an underlying asset. In some cases, the return occurs if the market price or level of the underlying asset increases or decreases. In other cases, the return is dependent upon whether or not the market price or level of the underlying asset stays within a predetermined range. In all cases, principal is protected only up to a predetermined cap amount. Accordingly, investors may lose some of their initial principal investment. Investors in Principal Protected Notes risk receiving no positive return on their principal investment if the underlying asset fails to move in a specific manner. In addition, investors may not receive the same return as if they had invested directly in the underlying asset. The notes may be structured as to provide a return to investors if the underlying asset appreciates, depreciates or remains within a predetermined range. Principal Protected Notes may be linked to a variety of underlying assets including, but not limited to, equity indices, commodities, foreign currencies or interest rates. Principal Protected Notes may be an appropriate investment for

investors seeking principal protection while simultaneously gaining

some exposure to an asset class. |

||||||||