|

|

| Overview | How to Calculate | For Example | Risk | |||||

|

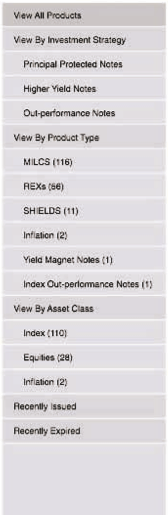

Yield Magnet Notes: How are the Coupons Calculated? For a specified initial period, Yield Magnet Notes will pay a fixed coupon payment. Thereafter, coupon payments will vary based on the price performance of the individual stocks in the underlying portfolio. The variable coupons will be calculated in each coupon period by determining the price return of each stock in the underlying portfolio on a fixed valuation date as compared to that on the day the notes are priced and then determining the average price return across the underlying portfolio. The contribution of each stock to the average price return across the underlying portfolio can be no less than a predetermined lower boundary and no higher than a predetermined upper boundary. In addition, the Magnet features apply as follows:

|

||||||||