| Introducing S-Notes | Why S-Notes | Personalized Notes | Risk Considerations | About ABN AMRO | Brochure |

S-Notes and the Risk/Return Continuum

Assess Investor's Risk/Return Profile...

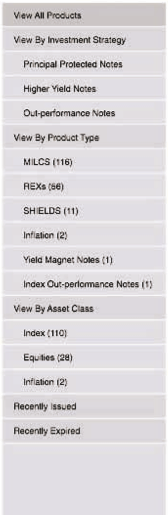

S-Notes may be structured to fit within an individual investor's risk/return profile across a wide range of asset classes.

S-Notes are available along the risk/return continuum' from the conservative investor concerned about principal protection to the risk tolerant investor seeking enhanced returns through a non-principal protected investment.

Financial advisors can select products from the S-Notes Family to fit within an individual investor's risk/return profile.

...and determine Investor's Asset Allocation Priorities

After determining their individual asset allocation profile, investors and their financial advisors may use S-Notes to achieve the following:

Chart the Course: Evaluate which S-Notes products fit into an investor's overall portfolio

Navigate the Waters: Track the performance of S-Notes throughout their term

S-Notes may be linked to a wide array of asset classes to complement traditional investments. Within an overall portfolio, investors and their financial advisors can determine how S-Notes may be used to achieve investors’ investment objectives by asking the following:

- In what asset classes is the investor under- or over-allocated?

- Within each specific asset class, does the investor want principal protection or the possibility of an enhanced return?

- Does the investor require greater current income or is the investor willing to defer income in exchange for additional potential appreciation?

S-Notes Features

Incorporating Structured Notes into an Investment Portfolio may Provide Several Advantages

S-Notes can complement any well diversified portfolio, providing the following advantages:

Innovation

The structured products market is constantly evolving and ABN AMRO is a frequent developer of new products. The S-Notes platform allows for new products to be brought to market quickly. ABN AMRO has also worked quickly to adapt to changes in the regulatory framework. ABN AMRO was the issuer to use SEC registered brochures to market structured products.Access

Some investors find it problematic or uneconomic to invest in certain asset classes, such as commodities and foreign currencies. S-Notes may be used to provide investors with exposure to the asset classes that they desire.Structure

Structured notes offer economics that individual investors do not often have the ability to recreate with traditional investments in a cost effective or convenient manner.